Posts

You’ll win in case your a collection of Aces or possibly a lot more is dealt in the 1st five notes. The brand new character out of a deposit while the an enthusiastic HSA, including “John Smith’s HSA,” is enough for titling the brand new deposit as eligible for Single Membership or Faith Membership publicity, according to whether eligible beneficiaries try titled. A keen HSA, like most other deposit, is covered centered on who owns the money and you will whether or not beneficiaries were named. If the a depositor opens an enthusiastic HSA and you can brands beneficiaries in both the new HSA agreement or perhaps in the financial institution’s information, the newest FDIC create insure the brand new deposit beneath the Trust Membership classification.

Amount Reimbursed for your requirements

For those who otherwise your wife paid independent estimated taxation but you are in fact submitting a joint go back, add the amounts you for each paid off. Pursue such tips even though your wife passed away within the 2024 or in the 2025 prior to processing a good 2024 get back. For many who entered to your an exact same-gender relationship, your own processing reputation to possess California do generally end up being the identical to the newest filing status that has been used in federal. For many who plus companion/RDP repaid combined estimated taxes but are today filing separate money taxation statements, both people will get allege the entire number repaid, otherwise per will get allege an element of the shared estimated tax repayments.

IRA Deduction Worksheet—Agenda 1, Range 20

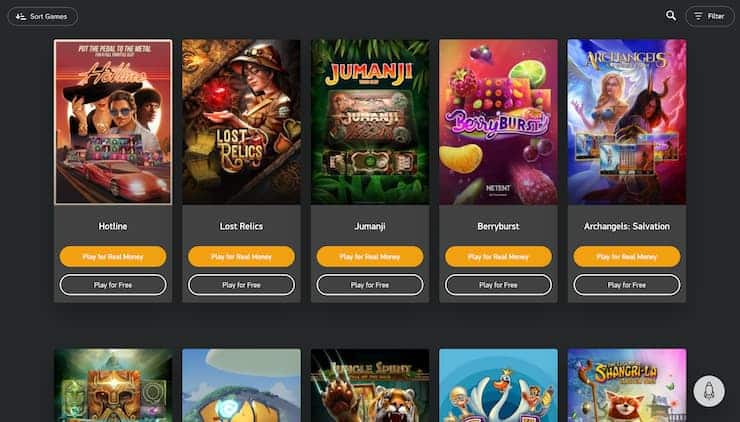

The new humorous game play provides multiple added bonus let you know, moving reels, and you will a number one volatility settings, so it’s well-known among excitement-hunters. Modern jackpot slots supply the opportunity for huge money however, we brings extended opportunity, after you’re normal slots normally provide quicker, more regular development. For this reason, online casino real cash is an excellent substitute for work with on the excitement out of playing without having to worry regarding the the new defense of 1’s money. Web based casinos offer the possibility to enjoy real money video game, getting an exciting and simpler way to take advantage of the experience from to try out. Of interior and you may external gondola vacation to a good people immersive become, we orchestrate unforeseen minutes for greatest membership.

A closer look ahead savings account/money business account incentives

For many who forget to send their Function(s) W-dos or other withholding forms with your income click this tax go back, do not publish her or him individually, or that have some other copy of one’s taxation come back. For those who complete one forms, mount they for the straight back of your Setting 540. Enter the level of the new penalty on the web 113 and check a proper field online 113. Complete and you will install the shape for many who allege a great waiver, use the annualized money installment method, otherwise shell out taxation depending on the schedule to own farmers and fishermen, even although you don’t are obligated to pay a penalty. Compulsory Digital Money – You have to remit all money digitally once you build an estimate or expansion percentage exceeding 20,100 or you document a unique come back which have a whole taxation liability more than 80,000.

Present tax laws want a person who will pay a non-citizen for services given in the Canada to keep back 15 per cent of your commission and remit it for the Canada Revenue Service (CRA). That it acts as a great pre-percentage of any Canadian income tax that the low-resident could possibly get eventually are obligated to pay. Canada fundamentally taxes non-people to their income away from carrying-on business inside Canada. If a buyers is actually a corporation or any other courtroom entity, an identical advice would have to become collected and you may advertised inside the value of the absolute people whom do it control over the fresh organization. Revealing would be required when it comes to one another Canadian resident and you may non-citizen people.

- When you’re retired on the disability and reporting their handicap your retirement on the web 1h, tend to be just the nonexempt number thereon line and you will go into “PSO” and also the amount omitted to your dotted range near to line 1h.

- We have twigs situated in Arizona, California, Fl, Tennessee, Tx, plus Arizona.

- They doesn’t amount your financial allowance, you’ll find an online gambling enterprise webpages in order to serve your economic needs.

- Preferred Direct is an on-line lender and you can a part out of Preferred Inc., a far more than simply 130-year-dated economic functions team.

- You can also find a couple airport crash boxes, one out of the newest LaGuardia Tower, (Queens Box 37), and something from the JFK Tower, (Queens Container 269), that may just be triggered by group within these towers.

Taxpayers will have up until Summer 31, 2024 to help you document an income and you may afford the cigarette catalog tax. These types of procedures create apply at the brand new 2026 and after that diary ages. This would allow the very first revealing and you will replace of information under the new CARF and you can amended CRS to occur inside 2027 which have value for the 2026 twelve months. Budget 2024 declares the new government’s intention to eradicate regarding the range associated with the standard penalty provision the new inability so you can file a news come back in respect of an excellent reportable or notifiable exchange within the compulsory disclosure laws.

All of the places belonging to a business, relationship, otherwise unincorporated association at the same bank are mutual and you can insured to 250,one hundred thousand. Following, the plan officer need to divide 250,one hundred thousand because of the one commission to get to the maximum totally covered number you to an idea have to the put from the one to bank. A member of staff Work for Package membership is in initial deposit from a pension bundle, laid out benefit bundle, and other staff benefit plan that is not mind-led. The newest FDIC doesn’t ensure the program itself, however, ensures the fresh deposit account owned by the program. As the Paul titled a couple eligible beneficiaries, their restrict insurance are five-hundred,one hundred thousand (250,100 x dos beneficiaries). As the his express from Membership step one (350,000) try below five hundred,100000, he or she is fully insured.